Local Memo: Google Search Console Drops Page Experience Report, Adds Recommendations

Driving Sales, Nurturing Journeys: Unveiling the Power of SOCi for Financial Services Companies

Driving Sales, Nurturing Journeys: Unveiling the Power of SOCi for Financial Services Companies

As a financial services company, two main goals are to win new clients and retain existing ones. A research study by Salesforce found that customers want businesses to understand their requirements and expectations, while 66% feel they are often treated as numbers. Many firms don't have the time and resources to put extra effort into marketing strategies that can boost ROI. Marketing technology (MarTech) solutions like SOCi can help make the marketing process more manageable for the financial services industry, increasing customer satisfaction. It's a win-win! This blog explains what makes a strong digital marketing strategy, why it's essential, and how SOCi can help your firms get there.The Key Components of a Strong Digital Marketing Strategy

A successful digital marketing strategy has three main components: search, social, and reputation management. While many companies may focus on their social media efforts or online reputation individually, optimizing all three elements to form a solid customer experience is more impactful Regardless of when a customer starts their journey with your firm, they should be able to find important information about your firm easily and feel seen and heard.1. Improve How You’re Found

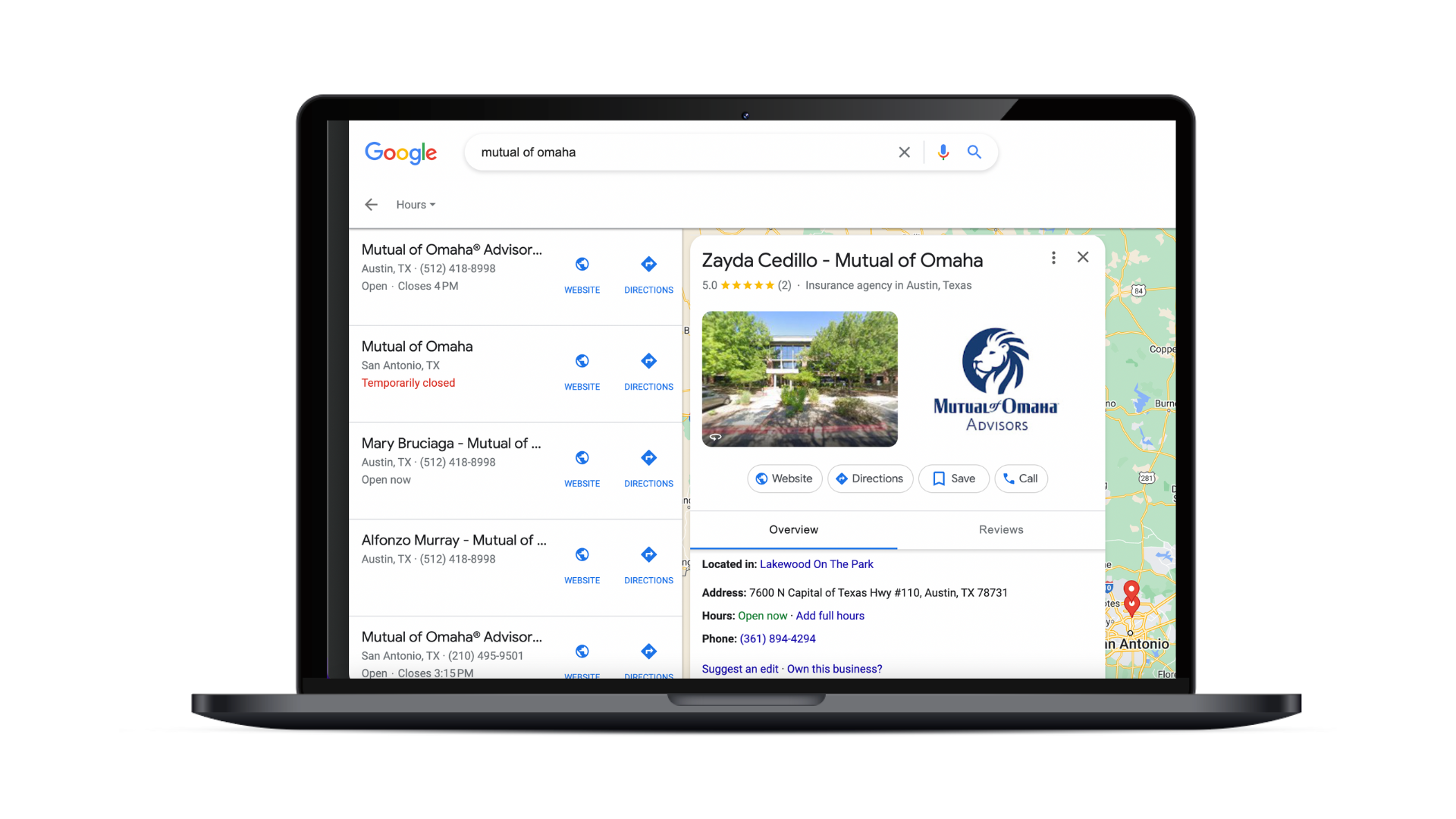

In a survey of more than 1,000 U.S. consumers, SOCi found that 80% of people search for online businesses weekly, with 32% doing so daily or multiple times a day.

How SOCi Can Help With Search

So, where does SOCi come into the picture? SOCi has solutions like SOCi Listings and SOCi Local Pages that can help you manage your listings and local pages at each branch or for every agent! Combined, these tools allow financial services companies to deliver a search-optimized and localized experience, resulting in the following:- Improved local search rankings

- Brand consistency across locations

- Local conversion funnel optimization

- Increased local foot traffic and revenue

2. Communicate With Clients Regularly

While ensuring your financial services company is visible is one part of the marketing equation, connecting with your target audience online is equally important. Your firm can do this through social media, especially at the local level. Consider what your social media presence looks like today. Which social platforms is your firm most active on? Do you have individual accounts for each business location? What kind of content are you posting regularly? Reflect on your social media strategy to pinpoint your financial services company's strengths and areas for improvement.When it comes to social media, localized content performs 12x better than non-localized content — emphasizing the need for brands to post content at the local level. While the type of content you post is important, how you interact with your audience on social media is also important. The same survey we mentioned earlier found that 82% of consumers say they sometimes post comments and questions on online profiles for businesses. Surprisingly, only 31% say the brand responded quickly to their last comment or question, and only 57% got any response at all.

How SOCi Can Help With Social

SOCi's social solution is the most comprehensive compliance solution financial services companies can leverage to scale social media management. SOCi Social allows financial companies to:- Decrease potential compliance risk with keyword-based policies and real-time alerts

- Save time with automated content and brand supervision

- Streamline auditing with a complete record of social media activity across every location

3. Remain Reputable

Ninety-eight percent of consumers feel that reviews are essential when making purchase decisions. Similarly, reviews influence 85% of consumers in discovering a local financial institution. Even if your firm is easily found online and engages with customers on social media, a weak reputation management strategy can still cost you clients. While many think of a brand's reputation as its average star rating on local listings, a comprehensive reputation management strategy must go beyond that. When considering reputation management, financial services companies must consider the following:- Volume of reviews

- Review response rate

- Review response time

- The personalization of review responses

- Average star rating over time