Why Insurance Companies Need Localized Marketing

Why Insurance Companies Need Localized Marketing

The vast majority of Americans have some kind of insurance. More than 95 percent of homeowners have a form of home insurance, and 88 percent of drivers have some configuration of auto insurance. With so many insurance types and companies out there, it can be challenging for your insurance company and local insurance agents to get noticed. One way to rise above competitors is to have a localized marketing strategy. In this article, we’ll explain what localized marketing is, the different aspects of it, and how each works together to help your local insurance agents and brokers gain more clients and increase their revenue. We’ll also explain how SOCi’s software and solutions can help automate your insurance marketing strategy while helping you stay on brand and compliant with regulators.What is Localized Marketing?

Before going further, we need to define localized marketing. Localized marketing is the practice of creating and implementing a marketing strategy that is distributed at the local level. It’s understanding and meeting the needs of local customers and communities.The three main components of localized marketing are local search, online reputation management, and local social.Below, we’ll further explain what each of these localized marketing categories entail and tactics your local agents can implement to enhance their localized marketing efforts.

1. Invest in Local Search

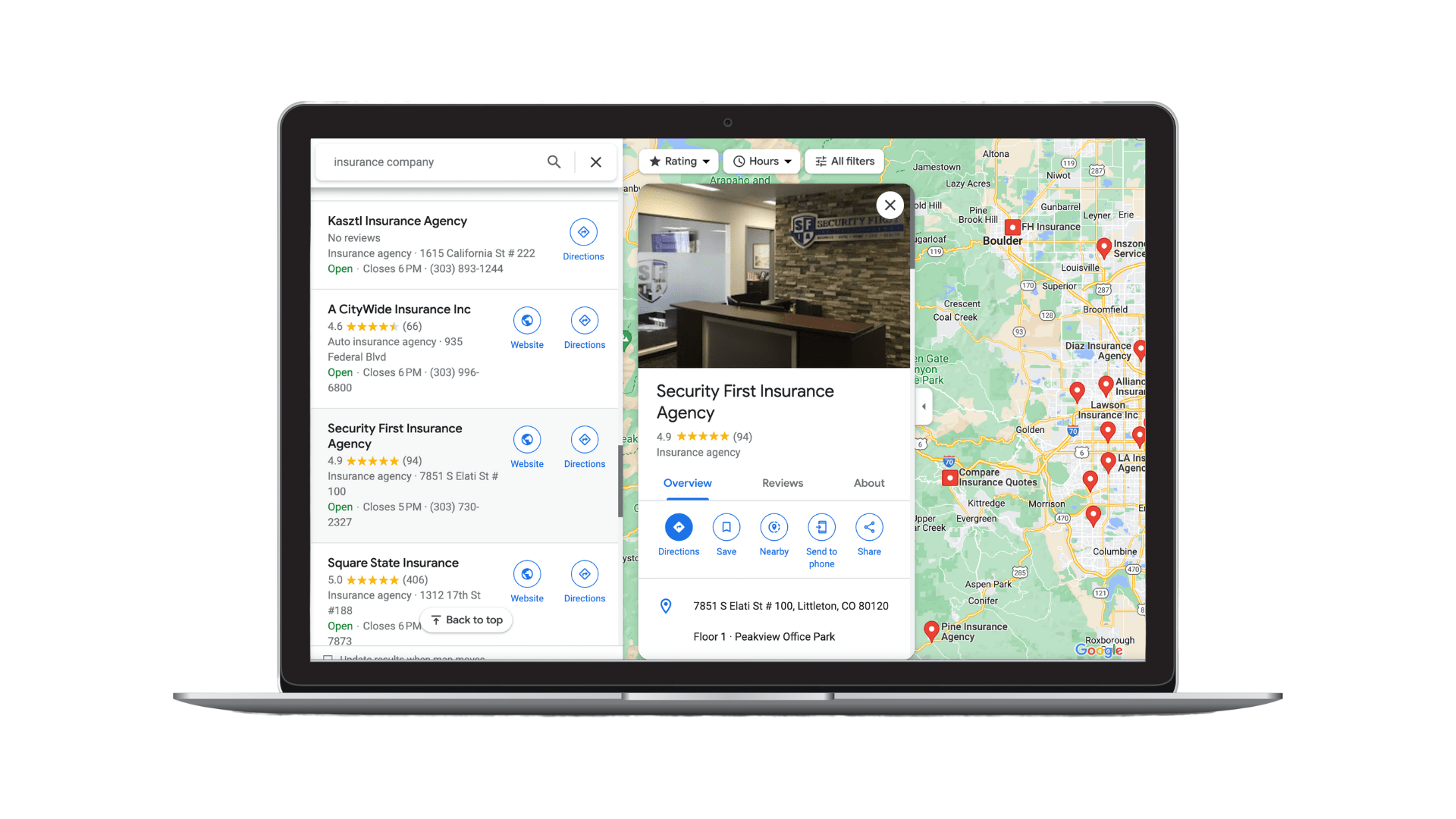

Local search, commonly called local SEO (search engine optimization), is the process of optimizing your website and online presence to increase visibility on search engines and attain more online traffic from consumers. One way local insurance agents can improve their local search rankings is by optimizing their local listings.Optimize Your Local Listings

If you don’t already know, local listings are business profiles of your local insurance company or agent that appear on search engines and local directories like Google, Yelp, or Facebook. When people search for local insurance providers or companies, local listings often appear on the search engine results page (SERP).

- Name, address, and phone number (NAP)

- Directions to your local office

- Links to your website and local social profiles

- Hours of operations

- Provided services

- High-quality photos and videos

- Categories

- Description

Make Local Search Easier With a Local Listings Solution

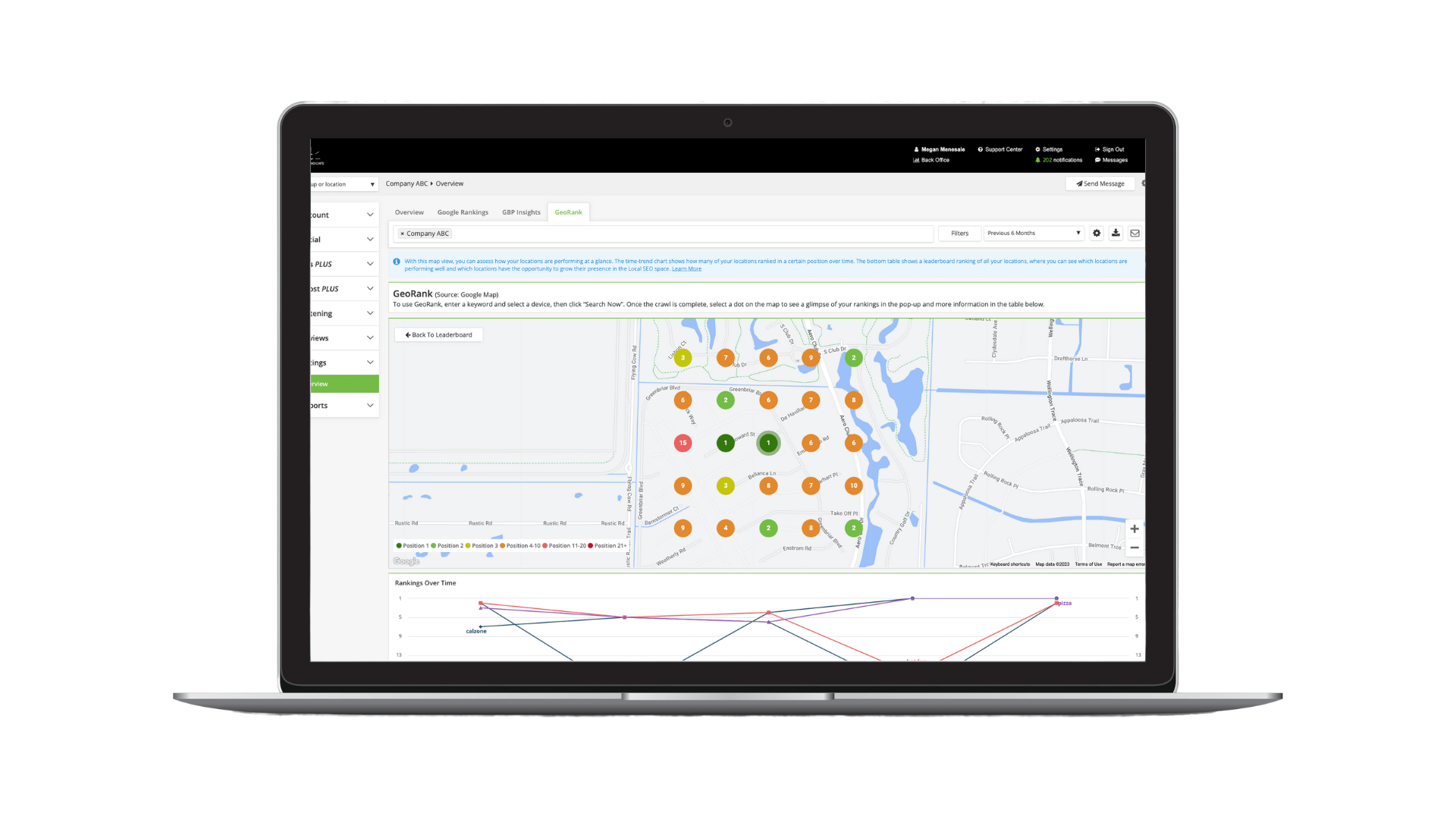

One issue insurance companies and their agent's face is managing their listings across dozens of local directories. Make local listings management easier with SOCi Listings. Our local listings solution can help improve your local SEO by ensuring you have all the necessary information filled out on each listing. Plus, SOCi GeoRank, our map-based keyword reporting software, helps your insurance company and agents gain insight into how their offices stack up against competitors for the most important keywords.

2. Participate in Online Reputation Management

The second pillar of localized marketing is online reputation management (ORM). ORM at the local level is the process of monitoring and influencing what’s being said about local insurance agents or brokers. A lot of ORM deals with gaining, monitoring, and responding to reviews.Gain Client Testimonials and Reviews

Gaining reviews for your local listings can help with your ORM, local search rankings, and conversion rate. Reviews help your local listings, like your GBP, rank higher on search engines. According to local SEO experts, two of the top local search ranking factors are high numerical ratings and the quantity of reviews with text. Ratings and reviews also improve conversion rates. Our research shows that conversion improves by 44 percent when a GBP increases its average star rating by one full star. It’s evident that agents should work towards getting as many positive reviews on their local listings as possible. Here are a few ways agents can acquire more reviews.

Monitor and Respond to Reviews

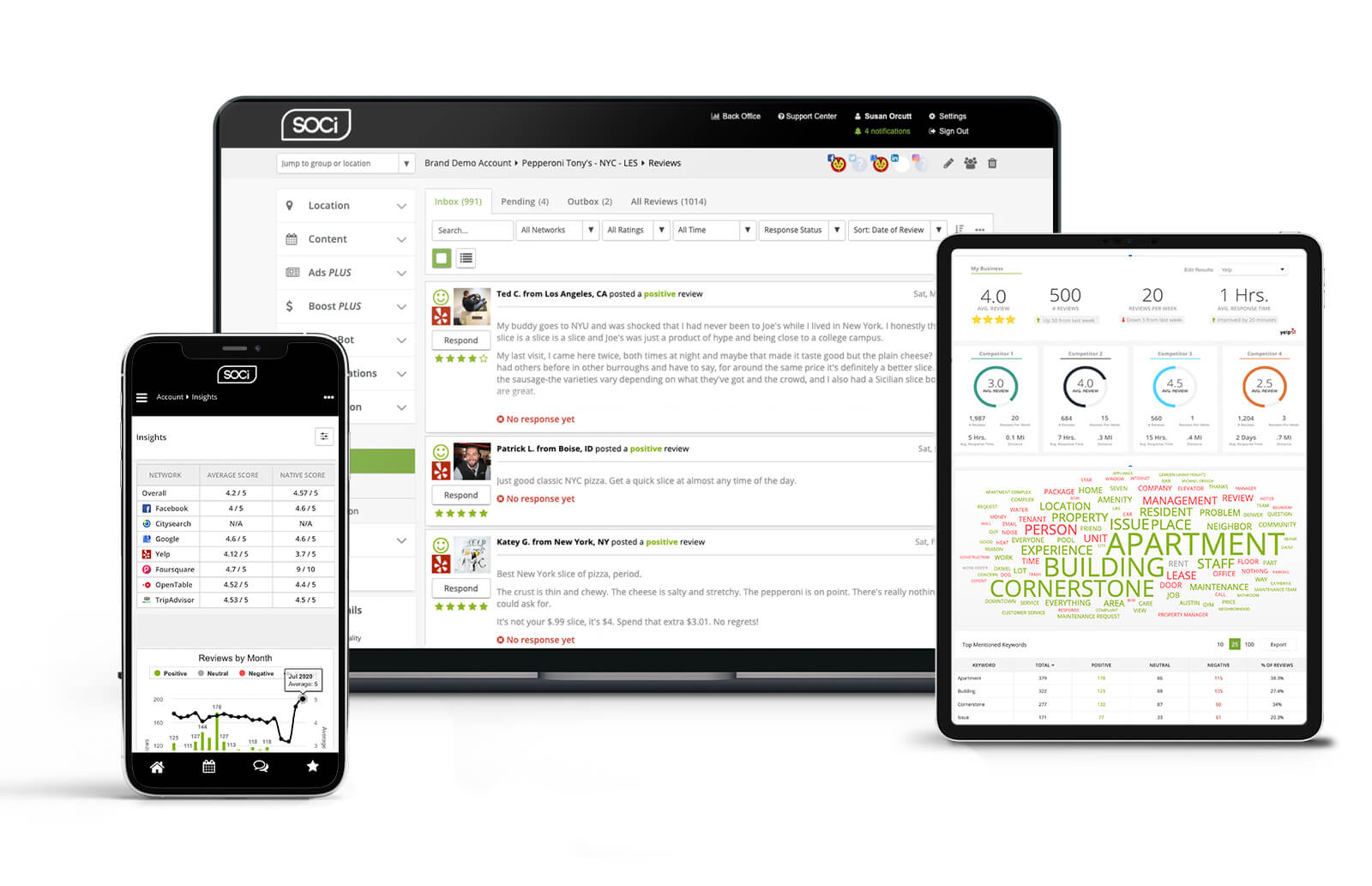

Another aspect of ORM is monitoring and responding to reviews. Current clients want to be well taken care of and responded to while potential clients want to ensure they receive the same treatment. Responding to reviews shows current and future clients that you care about their feedback and look to improve your local insurance agency. Furthermore, we found responding to reviews also boosts conversions. For every 25 reviews responded to, conversion on GBPs improves by 4.1 percent. Download our Multi-Location Marketers Guide to Online Reputation Management for detailed strategies on how to manage and respond to reviews.Employ Software to Streamline Your Reputation Management

If your corporate team and local insurance agents are having a difficult time managing and responding to reviews in a timely manner, consider using SOCi Reviews. Our reviews software uses sentiment analysis technology to track how clients perceive different agencies and agents, which helps corporate and local teams identify areas of improvement. Furthermore, you can use SOCi Reviews to respond quickly to customers. Our integration with Open AI’s ChatGPT uses machine learning algorithms to provide fast and accurate responses to clients in real time. It’s worth noting that as an insurance company, a human touch is still needed to ensure the response falls within compliance guidelines.

3. Utilize Local Social

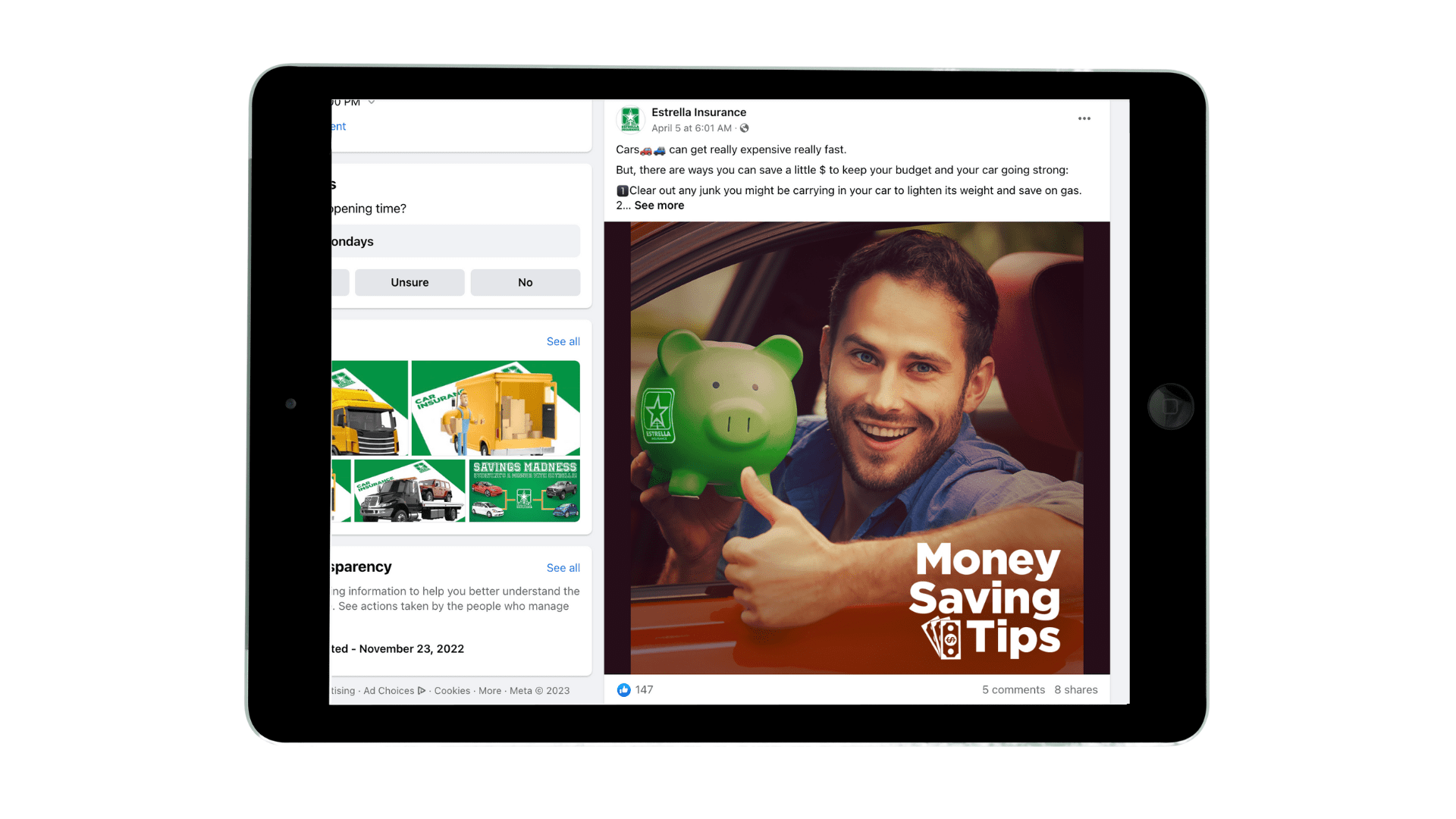

The third and final aspect of localized marketing for insurance companies is local social, sometimes referred to as localized social. Local social is when individual agents have their own local social media profiles and publish on them to generate new leads and retain customers. Localized content receives 12x the engagement compared to non-localized content. Therefore, it’s imperative that insurance companies have a local social strategy.Types of Local Social Content

In general, your local social agents should each have their own social pages and publish engaging and interactive content. Understanding your agents’ target audience and demographics will help determine which social platforms to put the most energy towards. That said, Facebook is a must, with 2.96 billion monthly users worldwide. Here’s an example of an insurance company’s local Facebook post: