How Negative Reviews Impact Your Business (and How to Fix Them Fast)

Navigating the Digital Divide: Financial Services in the Age of Social Media

Navigating the Digital Divide: Financial Services in the Age of Social Media

Social media has become the anchor of consumer engagement, yet the financial services sector remains underrepresented on social platforms. This absence can be attributed to two primary challenges that financial institutions face: resource constraints and compliance complexities.

Resource Constraints: A Barrier to Engagement

Firstly, many financial services firms struggle with the challenges of resource allocation. Creating compelling, engaging social media content that resonates with a younger, more digitally savvy audience requires a significant investment of time, expertise, and resources. This investment is not only in the creation of content but in the development of a strategic approach that aligns with the evolving consumption habits and preferences of modern consumers. Many firms find themselves at a crossroads, lacking either the in-house expertise to craft messages that strike a chord with this new audience or the bandwidth to consistently produce and manage such content amidst their other operational priorities.

Compliance Complexities: Navigating a Regulatory Maze

The second, and perhaps more daunting, challenge lies in the maze of regulatory compliance. The financial services industry is bound by strict regulations designed to protect consumers and ensure the integrity of financial advice and products. Any content shared by financial firms must adhere to these regulations, ensuring accuracy, transparency, and the avoidance of misleading information.

The task of ensuring compliance is compounded by the dynamic and interactive nature of social media. Every tweet, post, or story becomes a potential liability if not carefully vetted for compliance with both regulatory standards and brand guidelines. The absence of streamlined processes or technologies to facilitate this vetting process presents further challenges, leading to many firms caution of engaging with social media platforms.

The Cost of Caution: Missing the Digital Connection

This caution, however, comes at a cost. As the demographic shift continues and digital platforms become even more integrated into the fabric of daily financial decision-making, the absence of financial services firms from these conversations places them at a significant disadvantage.

It not only limits their ability to influence and educate the next generation of consumers but also restricts their ability to build trust and loyalty among a demographic that values transparency, authenticity, and engagement.

In addressing these challenges, the need for innovative solutions that can bridge the gap between regulatory compliance and dynamic social media engagement becomes clear. Many have tried juggling multiple tools – one for social, one for compliance – to alleviate this burden. However, this has made the need for a platform, not multiple tools, more apparent and essential for financial services firms.

SOCi: Revolutionizing Social Media Engagement for Financial Services

Recognizing the critical need for financial services to effectively engage on social media while navigating the challenges of compliance and resource allocation, SOCi, the leading CoMarketing Cloud, presents an innovative platform solution. We empower financial services firms to activate a social strategy that is localized, engaging, and compliant. Our award-winning social product offers a suite of features designed to extend corporate social strategies to each individual, granting them the autonomy to localize content so that it resonates more effectively with their audiences.

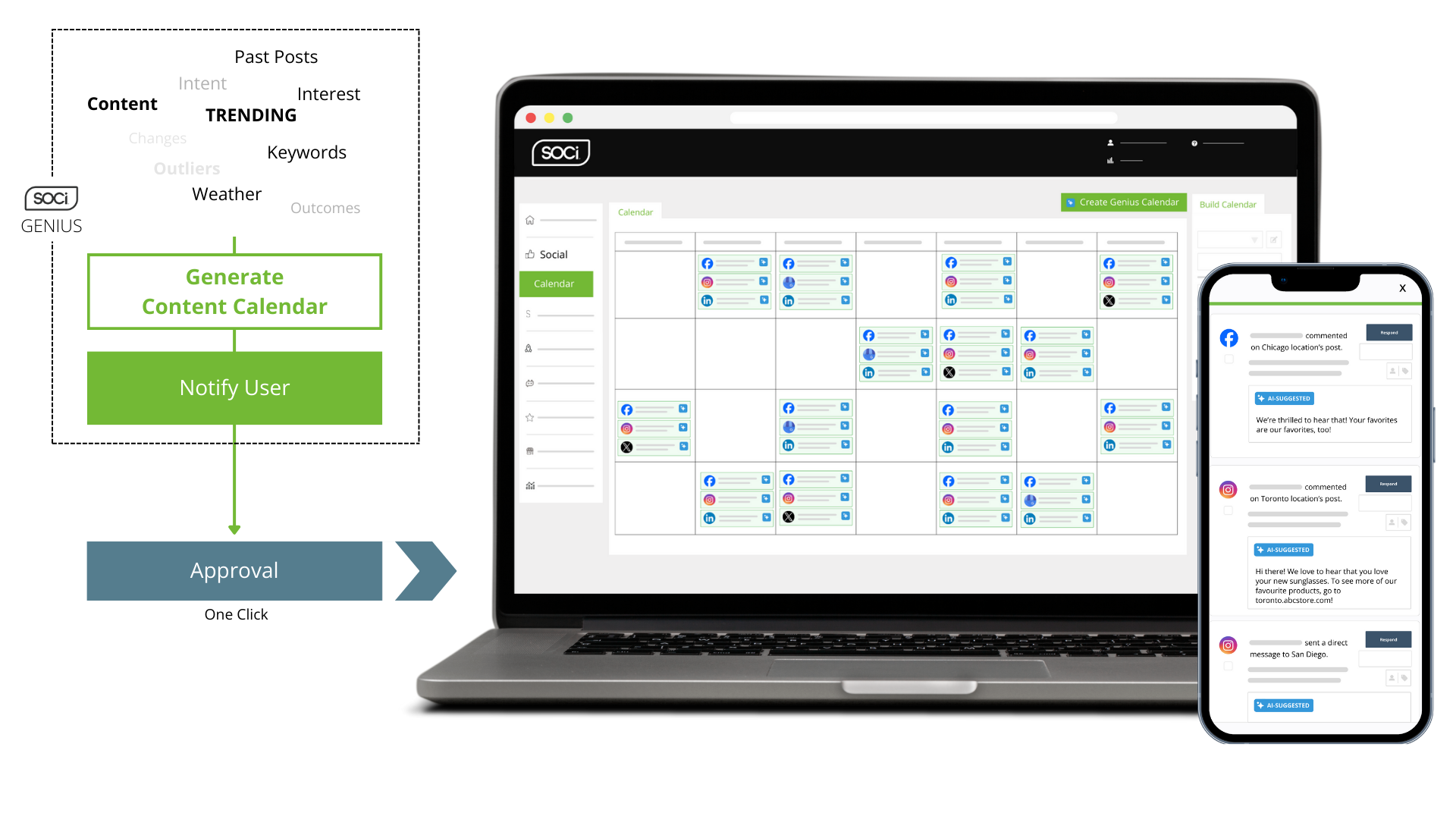

With the support of Genius Social, financial services marketers benefit from AI-generated social calendars automatically populated with optimized posts for each major social network. Providing an effortless way for financial services firms to infiltrate the social media landscape while ensuring all content is compliant and adheres to regulatory and brand standards, thanks to SOCi Shield. This comprehensive approach mitigates the risks associated with social media engagement and maximizes the potential for meaningful, authentic connections with consumers.

A New Era of Digital Engagement for Financial Services

In a world where digital engagement is preferred and expected, financial services firms face the dual challenge of creating compelling content and ensuring regulatory compliance. SOCi offers a powerful solution, enabling financial service marketers to harness the potential of social media to connect with a new generation of consumers on their terms.

By empowering agents with localized, AI-generated content and robust compliance safeguards, we are revolutionizing how financial services navigate the social media landscape, turning challenges into opportunities for growth and engagement. Request a demo with us now to learn more.