Future-Proof Finance: Bridging Generational Gaps for Financial Services Success

Future-Proof Finance: Bridging Generational Gaps for Financial Services Success

The great intergenerational wealth transfer is upon us. According to the New York Times, total family wealth in the U.S. increased by 268% from 1989 to 2022. A projected $84 trillion will be passed down from older Americans to Gen X, millennials, and Gen Z heirs through 2045. $16 trillion will transfer within the next decade.

Moreover, a UBS study found that of the 137 people who became billionaires in 2023, 53 of them (38%) received $150.8 billion through wealth transfers. The remaining 84 self-made billionaires amassed $140.7 billion.

This generational wealth transfer presents financial services institutions with an opportunity to retain families who are already clients and acquire new, younger clients, mainly millennials and Gen Z.

At SOCi, we’re aware of this massive generational wealth transfer. That’s why we’ve written this blog — to help you decipher Gen Z and millennials’ financial literacy and explain three key ways your financial services company can acquire these younger generations.

Millennials and Gen Z’s Financial Literacy

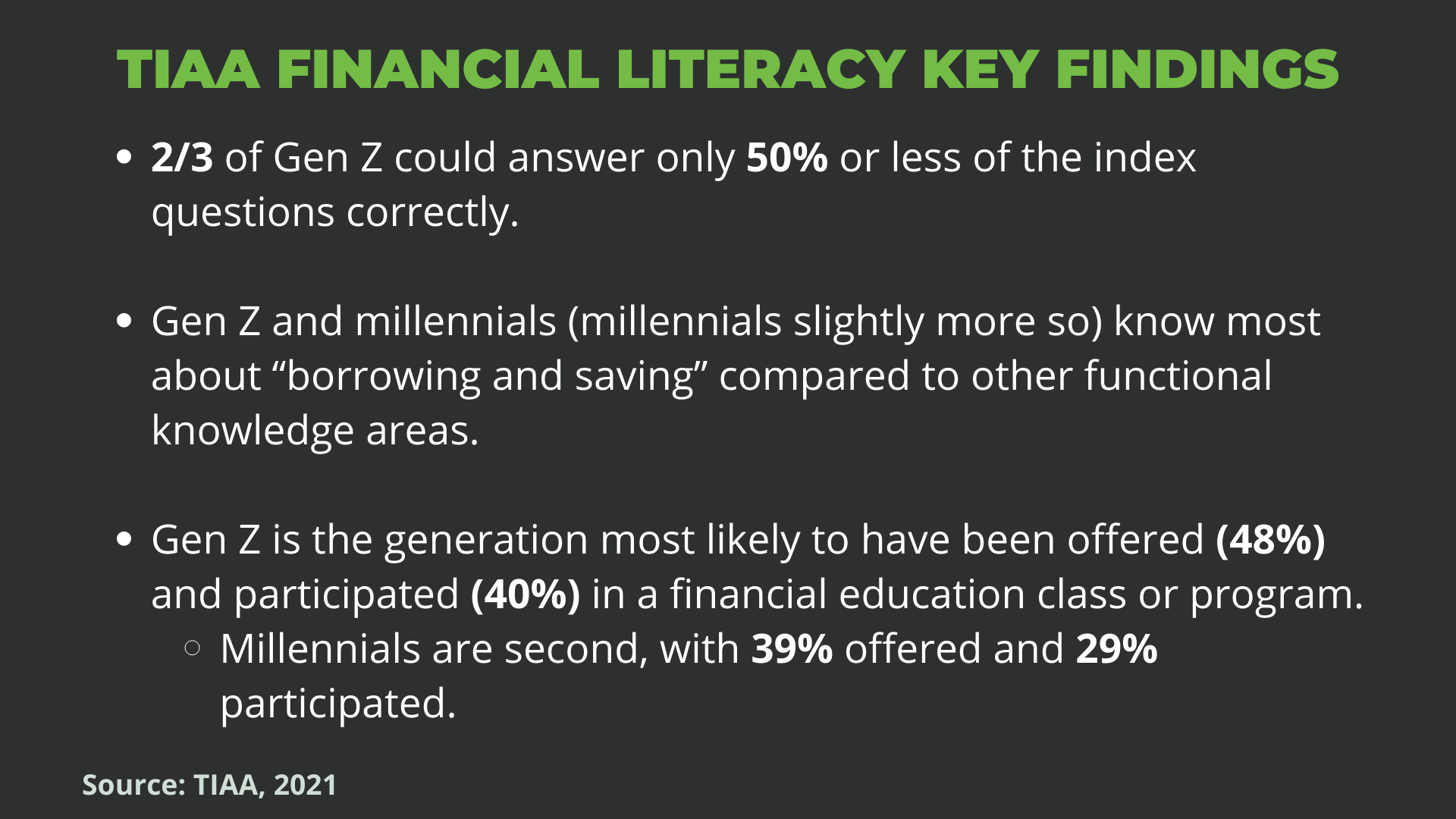

The TIAA (Teachers Insurance and Annuity Association of America) conducted a financial literacy survey across five generations. The survey’s findings give insight into how educated millennials and Gen Z are in finances and indicate each generation’s overall financial wellness.

Despite having less financial literacy than other generations, Gen Z is driven to improve their financial education and well-being. Many are turning to social media platforms like TikTok and Instagram and short-form content like video reels or YouTube shorts.

Three Ways Financial Services Companies Can Connect With Gen Z and Millennials

This younger generation’s eagerness to be more financially educated and independent, along with the massive upcoming generational wealth transfer, represents an incredible opportunity for financial services companies to acquire new clients.

Here are three ways your financial service company can acquire these eager millennials and Gen Zers.

1. Get Digital

According to a 2023 survey, 75% of millennials and Gen Zers use apps and social media as their primary financial education resource.

However, a financial education gap exists. Only 25% of Americans have received financial management information. Americans welcome financial advice. Of those 25%, two-thirds acted on the information they received.

So, what does “getting digital” mean for financial service companies?

It requires you to establish the following:

- A Social Media Presence: Establish a strong presence on social media platforms to engage with younger audiences. Share financial tips, industry news, and client success stories highlighting positive impacts.

- Apps: Develop user-friendly mobile apps that provide uncomplicated access to banking, investment, and financial planning services.

- Flexible and Customizable Products: Provide flexible financial products that individuals can customize to meet their needs and goals. This allows clients to have more control over their financial portfolios and strategies.

- Digital Banking Solutions: If you’re a bank or mortgage company, offer secure online banking experiences, like mobile check deposits, real-time transaction alerts, and instant money transfers.

- Financial Education and Planning Tools: Develop educational resources and tools that help younger clients understand financial concepts. Integrate budgeting apps, investment calculators, and other planning tools into your digital platforms.

This digital shift empowers younger generations with seamless access to financial tools, information, and personalized services.

It also positions your FinServ company as an experienced leader, helping clients navigate the daily shifts in the economic landscape and guiding families through their personal wealth transfer.

2. Promote Educational Content and Literacy

We touched on this earlier, but promoting educational-financial content is essential. In 2023, financial uncertainty caused 47% of Gen Z and 54% of millennials to feel depressed at least once a month, strikingly higher than Gen X (39%) and Boomers+ (20%).

Thus, these younger generations crave financial education, with 46% of Gen Z and millennials wanting to receive personal finance information regarding investment strategies.

This data highlights the need for financial services companies to produce the content that Gen Z and millennials crave. Doing so will help those that do stand out from competitors.

Content to Publish

Financial Advice

Financial advice is a great place to start. You’ll want to publish and promote content around the following:

Socially Responsible Spending

Gen Z and millennials actively pursue brands that relate to their values. They want to make ethical financial decisions. With this in mind, consider sharing what your FinServ company does regarding ethical investments.

Entrepreneurship and Side Hustles

According to one survey, half of Gen Z want to become entrepreneurs or start a business. Thus, promote helpful entrepreneurial information such as the best gig economy tips, side hustle ideas, small business tips, and how-to tax guides.

Cryptocurrency

According to an Investopedia survey, nearly a quarter of Gen Z and over a third of millennials currently invest in cryptocurrency. For millennials, cryptocurrency is their highest form of investment. With 41% of millennials saying they have an advanced understanding of digital currency, it’s worth publishing more developed content and advice on these topics.

Types of Content

It matters where and how you publish this financial content. In general, we recommend posting this content on Facebook, Instagram, TikTok, YouTube, and, depending on length, somewhere on your website.

Below are a few highly engaging content formats worth considering:

- Short educational videos or reels that explain vital financial concepts and investment strategies.

- Interactive infographics that visually represent financial information and include insightful statistics and beneficial tactics.

- Live Q&A sessions featuring your financial experts who address common concerns and queries from Gen Z and millennials.

- Polls and surveys to gather insights on your audience’s financial preferences and priorities and to interactively test their financial knowledge.

- User-generated content (UGC) that highlights your local teams or branches and client success stories.

3. Implement a Localized Marketing Strategy

Insider Intelligence found that 42% of U.S. Gen Z banking consumers would consider their proximity to ATMs as a factor before choosing a new bank, while 29% would consider their distance to a branch.

Additionally, 4 in 10 Gen Zers report that physical, bricks-and-mortar branches are essential to them because they bring “peace of mind.”

You need a localized marketing strategy to ensure consumers can find your company’s local banks. Localized marketing consists of three components: local search, local social, and online reputation management. Let’s take a brief look at what each entails.

Local Search

Local search ensures that your local landing pages and local listings, like your Google Business Profile, are complete with key business information consumers are searching for. This information includes business hours, phone and fax numbers, addresses, services and offerings. Read our article on multi-location local listings management for a detailed breakdown.

Local Social

Local social requires having local social media profiles connected to your:

- Brick-and-mortar branches

- Insurance agents

- Wealth managers

- Mortgage brokers

Local social includes publishing highly engaging content that we mentioned above on your local social pages and engaging with local consumers on these platforms.

Download our Localized Social Content Guide for Financial Services Companies for more local social tactics and strategies!

Online Reputation Management (ORM)

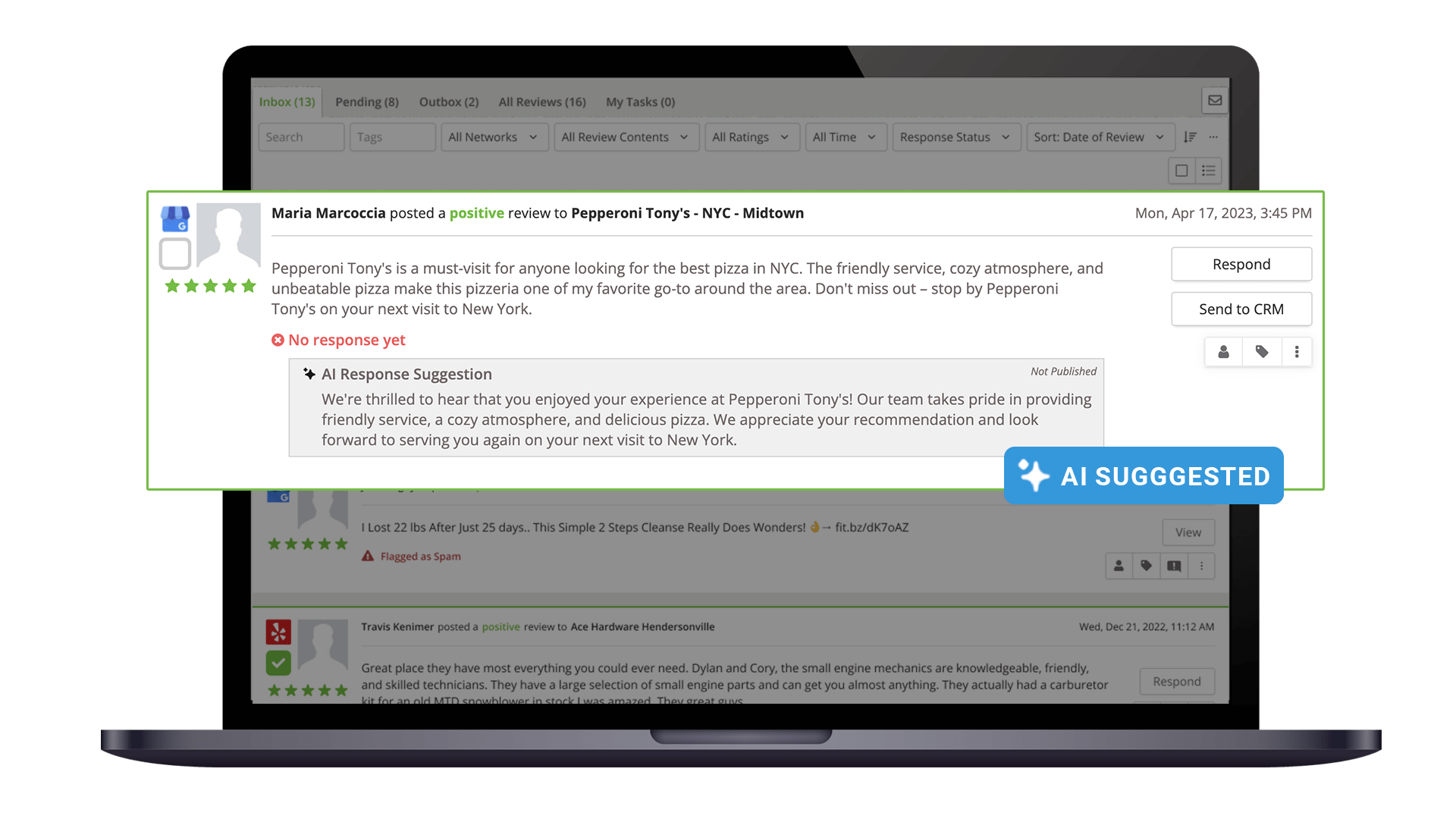

ORM means strategically shaping the digital narrative surrounding your FinServ company. It requires monitoring and responding to online reviews and engagements on your local listings and social profiles.

ORM also includes tracking sentiment analysis at each location and highlighting positive client experiences.

Together, these three branches of localized marketing work together to:

- Boost your branches’ organic rankings on search engines

- Improve your online reputation and brand perception

- Help obtain new younger clients

- Fortify trust between current clients to increase retention rates

For more information on the power of localized marketing, download The Guide to Localized Marketing ROI for Financial Services Companies.

Find the Solution That Works for Your FinServ Company

Gen Z and millennials are actively seeking financial service companies that assist them in managing their money and provide financial advice and education.

This desire for financial literacy and independence, coupled with the massive generational wealth transfer, presents an opportune moment for your financial service company to retain current families and acquire new, younger clients.

However, attracting and keeping local clients across each branch takes time and effort. That’s where SOCi comes in!

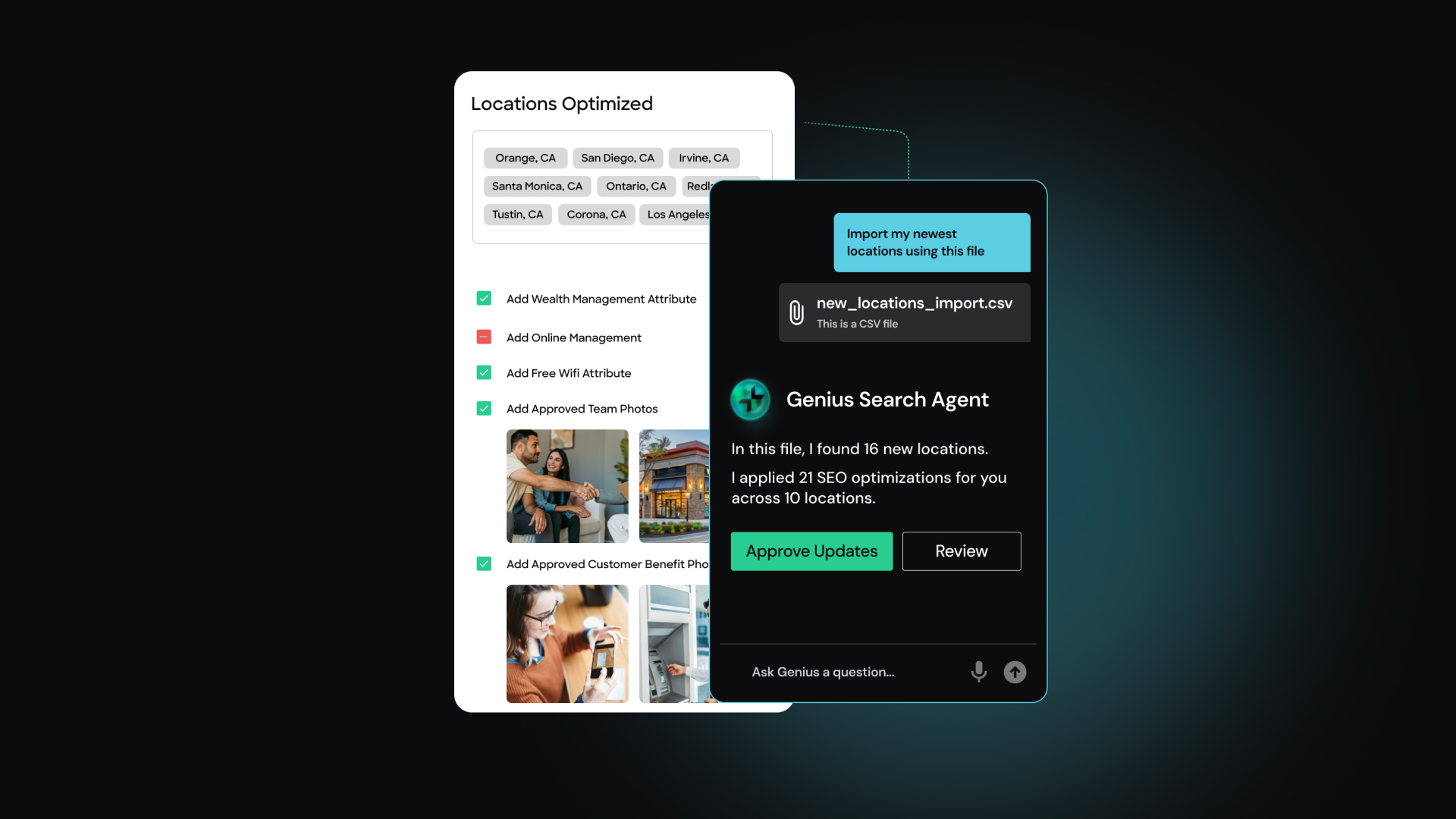

SOCi is the CoMarketing Cloud for multi-location businesses. SOCi empowers regulated brands, like FinServ companies, to drive more business to independent branches and agents — all while adhering to your compliance needs and regulatory guidelines.

We’re layering our comarketing software with SOCi Genius, which uses advanced data science, best-in-class generative AI, and “on-brand” training models to bolster your localized marketing strategy. SOCi Genius is your data scientist and marketer in one platform for each location.

With this cutting-edge technology, you can increase local brand visibility and engagements to drive more traffic and clients to your local branches and agents.

Request a demo today to see how SOCi can help your financial services company take advantage of this tremendous intergenerational wealth transfer and help bolster its localized marketing efforts!