Local Memo: Google Expands Social Posts Visibility in Local Search Results

5 Ways Financial Services Companies Can Leverage AI Today

5 Ways Financial Services Companies Can Leverage AI Today

Data from a recent SOCi survey found that 95% of marketers agree that artificial intelligence (AI) is a transformative force set to revolutionize marketing. While most agree on AI’s potential, 70% of marketers feel overwhelmed by its rapid development.

As a financial services company, now is the time to invest in AI. Those who do will set themselves up for success in 2024. If your company is already leveraging AI, kudos! If not, you’re not alone. Regardless of where you stand in your AI journey, this blog can help!

We’ll break down six tactics financial services companies can use to improve their localized marketing efforts with the help of AI.

Let’s get into it!

1. Leverage AI for Review Response

Financial services companies must understand the importance of responding to reviews. For instance, 98% of consumers feel that reviews are essential when making purchase decisions. Additionally, our State of Google Reviews research found that for every 25% of reviews responded to, the conversion on Google Business Profiles (GBPs) improves by 4.1%.

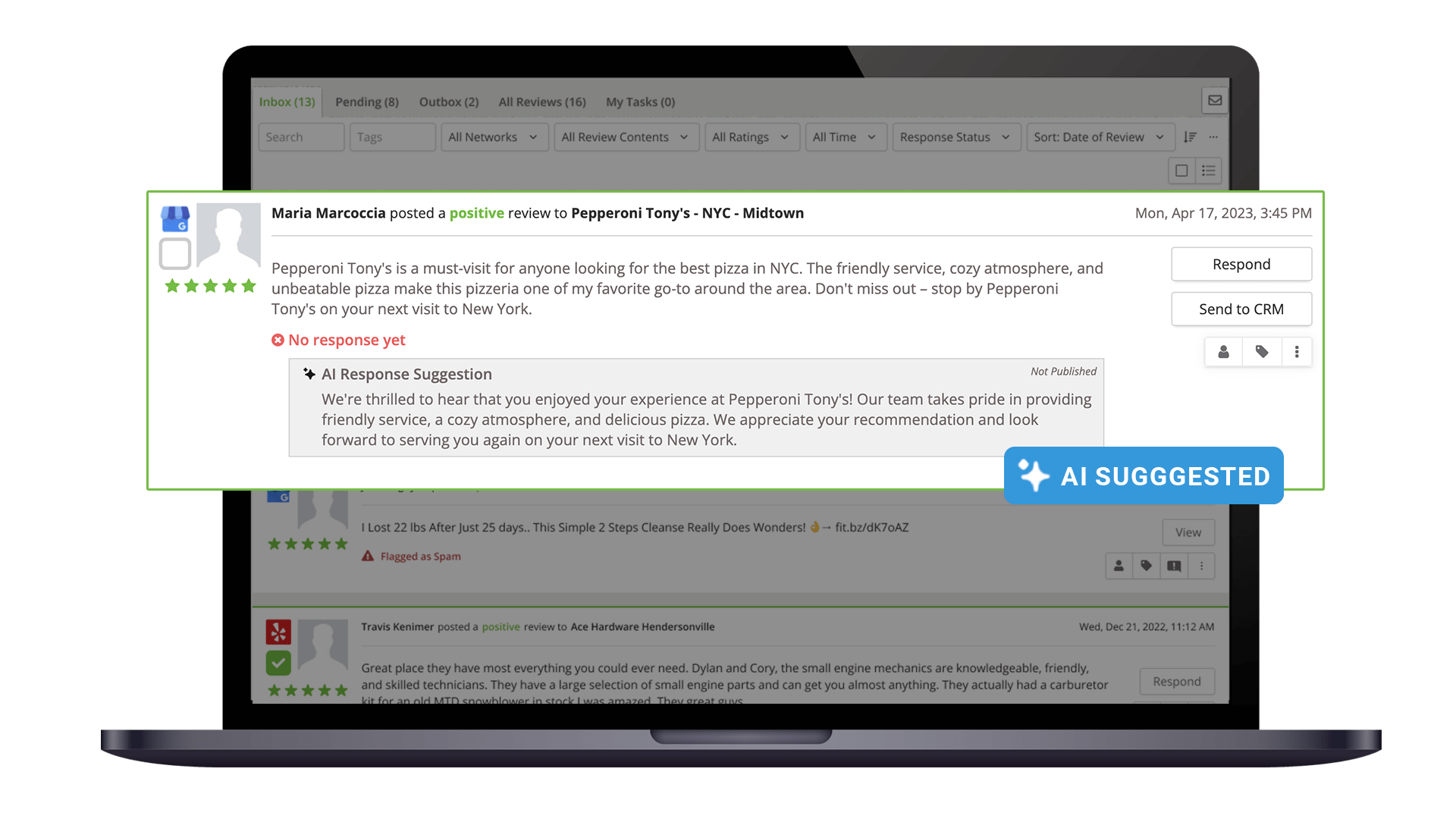

One of the most straightforward ways businesses, including financial services companies, are already winning with AI is through review response. Generative AI tools like ChatGPT and Jasper can help businesses automate review responses, a previously time-consuming task, particularly for financial services companies with numerous locations.

There’s also marketing technology (MarTech) software like SOCi that has incorporated AI into review response tools, streamlining the process further.

For instance, the example below shows SOCi’s Genius Reviews, which allows multi-location marketers to automatically aggregate and respond to all reviews at scale in an authentic and on-brand voice, increasing reputation and brand visibility.

2. Consider AI for Ad Development

As of 2023, social media ad spending in the US stood at $72.3 billion, with investments on track to surpass the 80-billion-dollar mark by 2026. If your financial services company isn’t leveraging social advertising, you could be losing out to competitors that do.

While your teams may not typically have the time or resources to adequately ideate and develop ad campaigns, AI can make it easier! From ideating the ad to producing creative assets and developing the script or copy, AI can help with nearly every step. There are several platforms your company can leverage to create ads through AI. You can also use free tools to help with certain parts of the process.

For instance, Meta announced they’re rolling out generative AI features that all advertisers can utilize through Meta’s Ad Manager. Meta has three new generative AI features: image expansion, background generation, and text variations, all of which are shown below.

Whether your financial services company is just getting started with an advertising strategy or you already have one in place, it’s worth exploring how AI can help.

3. Generate Social Media Content

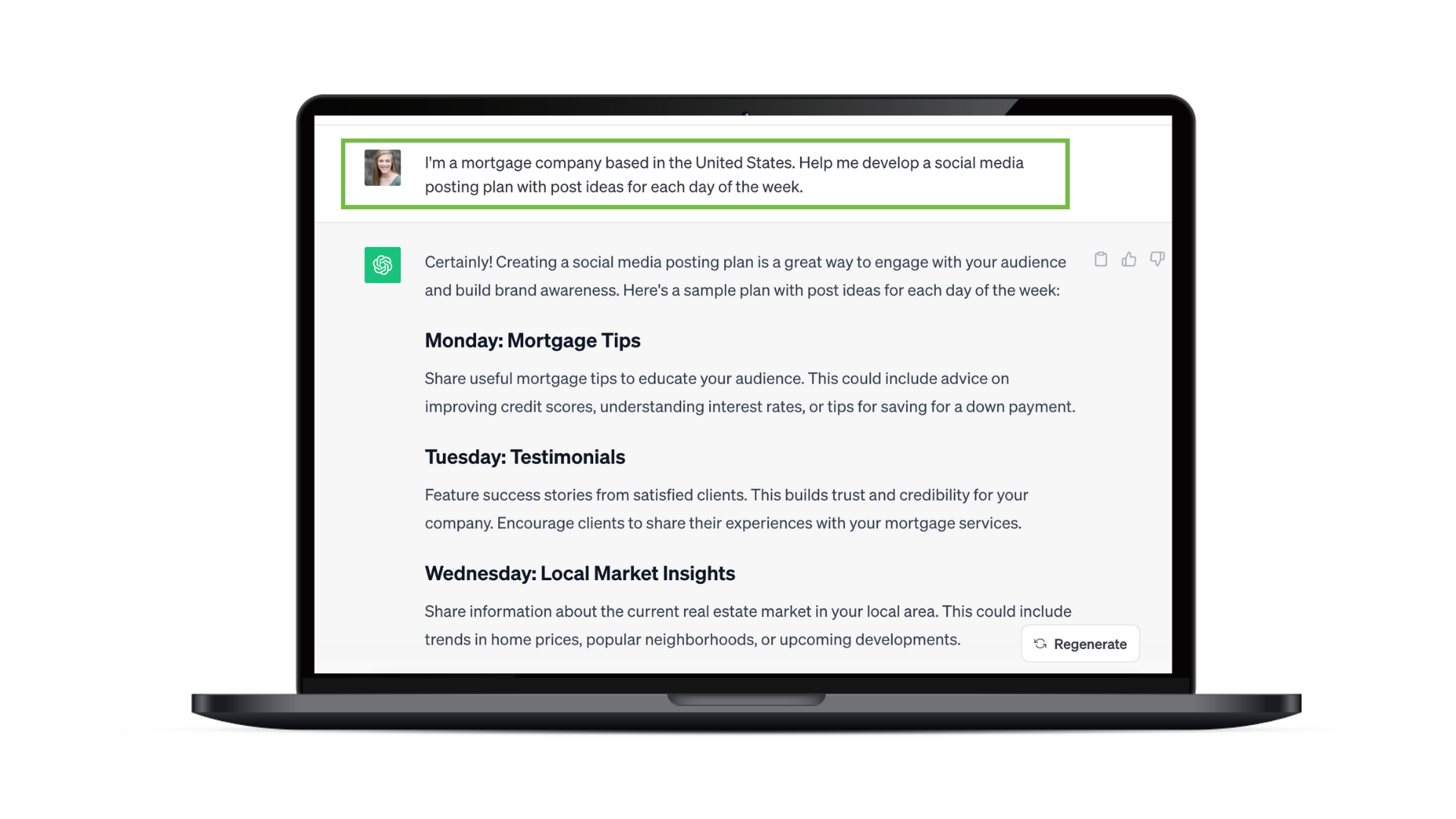

As expected, financial services companies can also use AI to develop social media content. Is your financial services company in a rut when posting content on social media? AI can help!

For instance, ask tools like ChatGPT or Jasper to develop a fun and engaging social post about income tax day. You can also take it further and ask the tool to develop a content strategy for your social media channels.

It’s important to remember that localized content performs 12x better on social media than content not considered localized. You should take the informative data and insights from your generative AI tools and modify them to individual branches or locations.. Local teams can also use the tools to develop locally relevant content.

4. Improve SEO and Online Visibility

In recent use cases, AI has also been found to help improve local SEO efforts and search visibility. AI has existed in search engines for several years and ensures that the content served in search results meets Google’s EEAT criteria (Experience, Expertise, Authority, and Trustworthiness). Your company’s content must meet these criteria to rank well on search engines or Google Maps.

If your financial services company wants to improve its SEO efforts, there are a few ways that AI technologies can help.

For instance, you can use AI to maximize keyword research. Tools like Semrush leverage AI and can help you quickly identify trending topics and new keyword opportunities. They also draft a keyword report on the search volume, keyword difficulty, and user intent for dozens of keywords.

On the other hand, generative AI tools can help your company optimize content from an SEO perspective. This includes, but is not limited to, drafting meta descriptions, inserting relevant long tail keywords throughout the content, and creating title tags.

Check out our AI and SEO blog post for a more detailed look at how you can implement AI into your SEO strategy. If you’re looking for additional ways to improve your SEO efforts, our Top 10 Things You Should Be Doing in Local SEO Now guide can help!

5. Refine Your Client Experience with Data and Insights

Last but not least, financial services companies can use the data gathered from AI to refine their client experience and win new business. For instance, your company likely receives thousands, if not millions, of client interactions daily across numerous platforms. With this vast amount of customer data, you need a centralized database to host these data points.

AI software can filter, organize, and analyze these data points and make actionable recommendations. These recommendations can be location-specific or at a regional and national scale.

For instance, you can use sentiment analysis to understand why certain branches or mortgage brokers have a stellar reputation. Then, you can develop a plan to incorporate their already-proven tactics across other locations.

As a financial services company, it’s crucial to make data-backed optimizations, and AI can help you do so.

Find the Right Solution for Your AI Journey

As you can see, there are numerous ways your financial services company can leverage AI to improve your marketing efforts. Not only will AI save your corporate and local teams time and effort, but it will also allow you to uplevel many aspects of your current strategy. While adopting and using AI is essential, many companies need help to navigate AI.

SOCi is here to help! At SOCi, we’re layering our comarketing software with SOCi Genius, an AI-powered automation layer. SOCi Genius leverages advanced data science, best-in-class generative AI, “on-brand” training models, and leading localization and automation tools to make data-driven decisions that fuel more innovative marketing strategies and increase ROI.

For a more in-depth look at how SOCi can help your brand win more customers and stand out from competitors with the help of AI, request a demo today!