Your Guide to Localized Marketing for Financial Services Companies

Your Guide to Localized Marketing for Financial Services Companies

As a financial services company, you likely understand the importance of marketing, but implementing a strategy across all your agents or businesses is often easier said than done. Compliance issues are one of the main setbacks financial services companies face when developing a comprehensive marketing strategy.

Within this blog, we’ll define localized marketing, break down its three components, and provide tips your financial services company can use when developing a strategy that takes compliance into account. Let’s get started!

A Look Into Localized Marketing

If you’re not familiar, localized marketing is the process of creating and implementing a marketing strategy distributed at the local level. For financial services companies, corporate-level employees must work with local agents or branches to create a cohesive localized marketing strategy and deploy localized marketing tactics across all locations.

Now, let’s get into the three main areas of localized marketing: local search, local social, and reputation management. In each section, we’ll explain how your financial services company can build a strong strategy for each.

Local Search

Focusing on local search and SEO is an excellent way for your financial services company to stand out online and appear in relevant search results. The more you put into your SEO efforts, the better your chance of ranking higher on search engines like Google.

Businesses in the Google 3-Pack receive 126 percent more traffic and 93 percent more actions (calls, website clicks, and driving directions) than businesses ranked 4-10, emphasizing the need for your company to rank high on Google through local search. Two critical components of local search are your local listings and local pages.

Local Listings

A local listing is today’s digital version of a Yellow Pages listing. It’s when an online directory mentions your local business. These local listings often include basic business information, such as your local business’s name, address, phone number, and a link to your website. Some directories will include customer reviews or payment options that you accept.

As a financial services company, claiming and optimizing your local listings across all major directories such as Google Maps and Search, Apple, and Facebook is crucial. Once you’ve claimed your local listings, you can begin optimizing them.

The most important information each local listing should include is the location’s name, address, and phone number (NAP). Once you’ve updated your local listings with your NAP information, it’s time to add more details.

Other details your business should include, if applicable, are:

- Links to local social media pages

- Payment forms accepted

- A business description

- High-quality photos

- Attributes (identifies as veteran-led, wheelchair accessible entrance, dogs welcome, etc.)

- Additional media (videos, photos of your location, and more)

- A call to action (CTA)

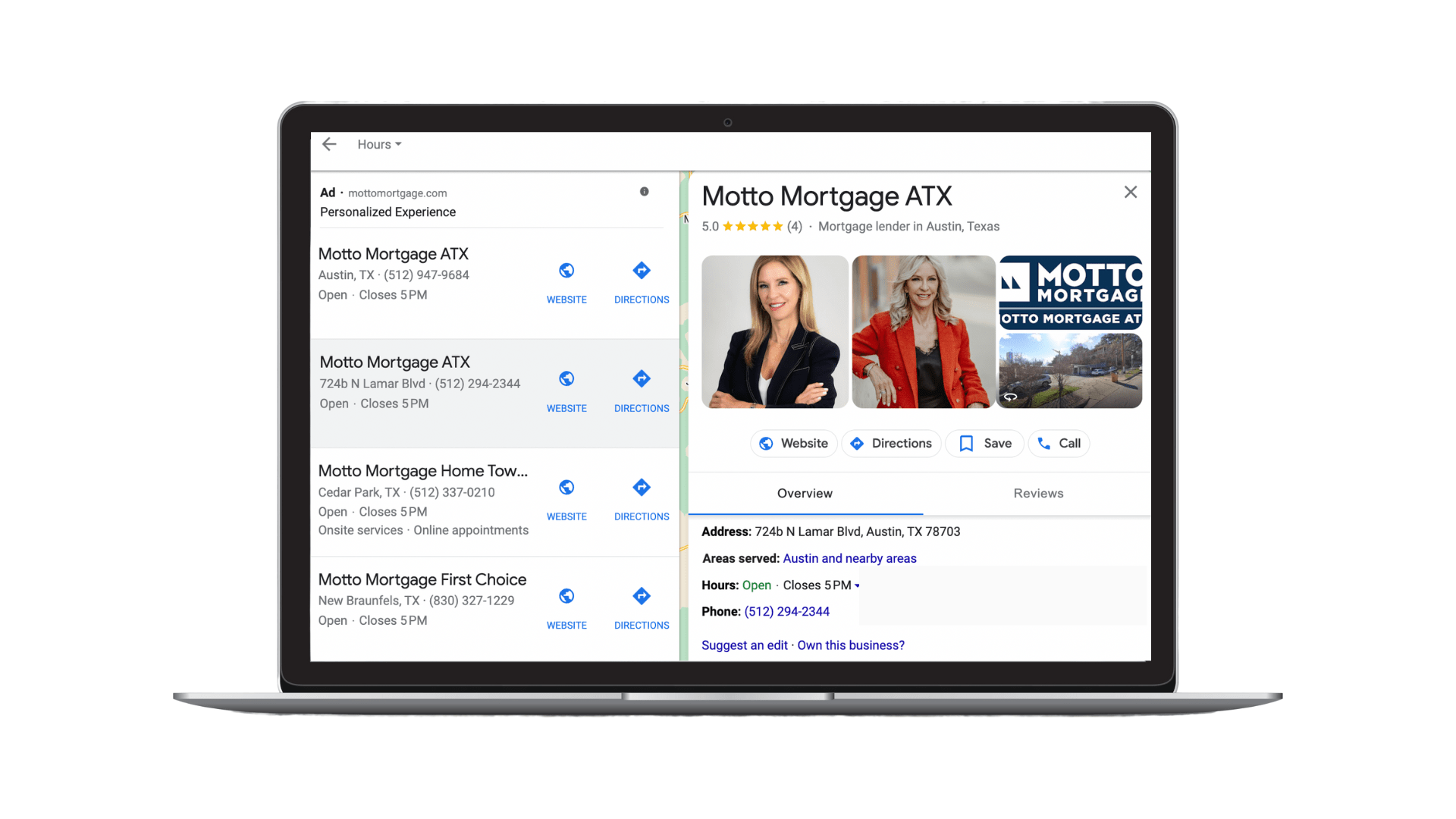

The more a potential customer can learn about your business without doing additional research, the better! SOCi client Motto Mortgage does a great job of optimizing their Google Business Profiles (GBPs), as seen in the example below.

Our blog, 5 Tips to Manage Local Listings for Financial Services Companies, provides a more in-depth look into strengthening your local listings.

Local Pages

Local pages are another way to improve local search visibility and drive more business for your agents or individual locations. A local page, often called a local landing page, is a specific web page for each business location.

Typically, local pages are published from your website, giving you complete control over what you post on them.

When creating local pages, they should include similar information to what is found in your local listings. You can also optimize your local pages by:

- Incorporating keywords

- Including high-quality images

- Adding alt text or tags to images

- Creating clean URL structures

- Ensuring meta description is enticing and contains relevant keywords

- Having multiple calls to action (CTAs) to increase lead conversion

- Showcasing user-generated content (UGC) such as reviews or customer testimonials

As a financial services company with multiple locations, local pages are a great way to help consumers get all the information they need about a specific agent or location from a single source. They also make contacting and doing business with your local branches or agents easy.

Local Social

Local social is the social media arm of localized marketing. Local social uses social media platforms to connect local branches or agents with local consumers to create a sense of community, improve brand awareness, and generate more sales.

As a financial services company, a solid local social strategy can differentiate your company from competitors. The data speaks for itself. Localized content receives 12x the engagement compared to content not considered localized.

If a potential customer is using social media and finds one of your competitors’ local agents or businesses promoting their services and can’t find your company on social media, which do you think they’ll go with? If your financial services company is just getting started with local social media, the first step is to ensure your agents or businesses have created or claimed local social pages on relevant platforms.

With 2.96 billion monthly users worldwide, Facebook is a must. You can also look at your target audience’s demographic data to help you determine which other platforms they’re spending time on. After your local social pages are claimed and ready to go, you can begin posting!

Here are some local post ideas and examples for financial services companies:

- Interactive calculators

- Post a short video or gif linking to your online local mortgage calculator.

- Quizzes

- Generate a quiz about insurance rates in different states or for different ages.

- Polls

- Start a poll asking followers about their favorite local places to visit or things to do in an area.

- Live Q&A session

- Start a live video or a Twitter thread letting your followers ask anything about the financial market or your industry.

- Giveaways and contests

- Create a contest for followers to like or follow another local agent or partner’s page for an entry into a giveaway.

For additional tips on creating a robust local social strategy for your financial services company, download our Localized Social Content Guide for Financial Services Companies.

Reputation Management

Online reputation management is the last component of localized marketing. More than half of consumers have passed up a business due to its ratings and reviews. Similarly, 87 percent of consumers read online reviews of local businesses. Managing the reputation of your financial services company is a must.

There are three main factors of reputation management your company should consider — the volume of reviews, review response rate, and overall star rating. You can find these reviews on listings and social platforms like Facebook, Google, and Yelp.

As a financial services company, you must decide who is responsible for responding to the reviews received, corporate, local agents or businesses, or a combination of the two. Regardless of who monitors and responds to reviews, you must ensure you respond to reviews in a timely and personalized manner.

For additional insight into what it takes to effectively manage your company’s online reputation management, download our Multi-Location Marketer’s Guide to Reputation Management.

See How Your Financial Services Company Stacks Up

With all the information needed to dominate your localized marketing efforts, it’s time to start. If you want to see where other financial services companies land when it comes to localized marketing to see what you’re up against, our 2022 Localized Marketing Benchmark Report (LMBR) can help.

Our 2022 Localized Marketing Benchmark Report (LMBR) examined more than 100 specific drivers of localized marketing success across local search, social media, and reputation — the three pillars of localized marketing.

The 2022 LMBR looked at numerous industries, including financial services. Meeting or exceeding the averages of financial services companies studied in the report is a great way to ensure you’re staying ahead of competitors.

Start Dominating Your Marketing Efforts Today

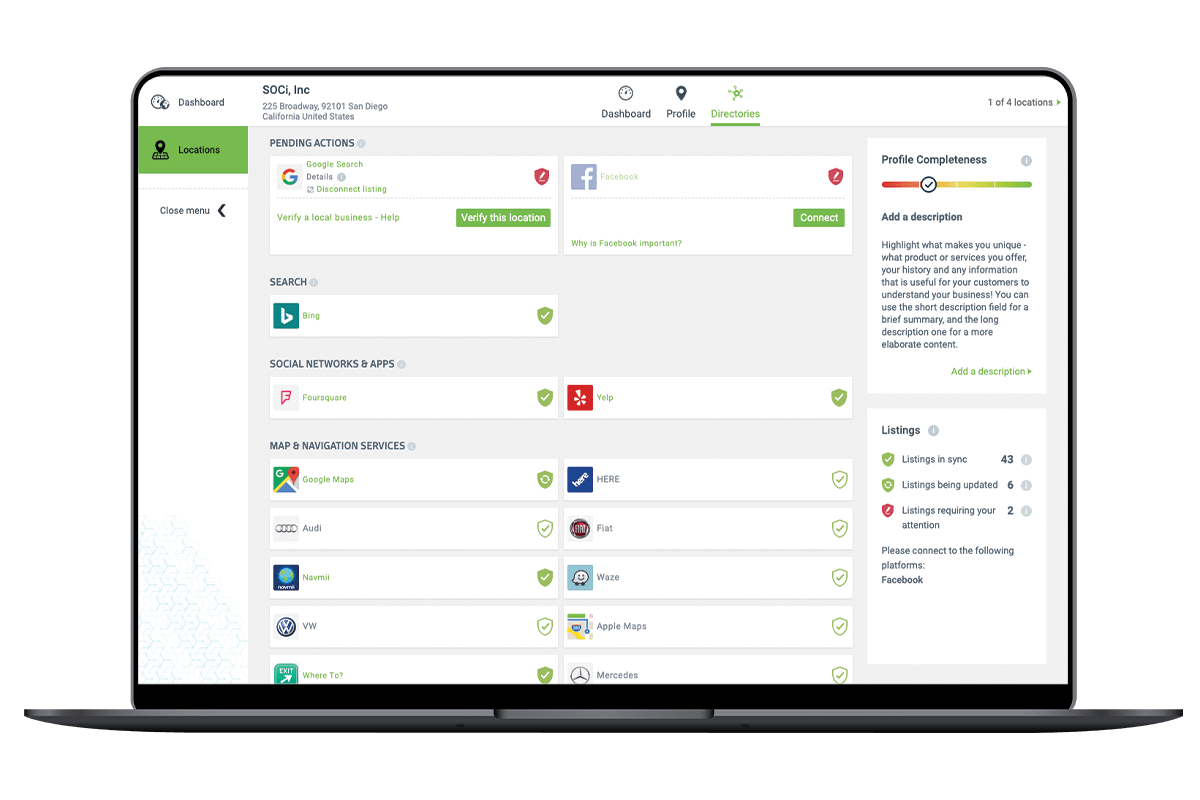

While managing localized marketing across your locations may seem challenging, SOCi is here to make it easier! SOCi has a combination of listings and social products with compliance and archiving features for financial services companies such as SOCi Listings.

SOCi Listings will help your company increase your listings’ data accuracy and improve local search rankings, resulting in stronger brand awareness and visibility. Learn how to easily maintain accurate, consistent listings across all your locations with SOCi Listings.

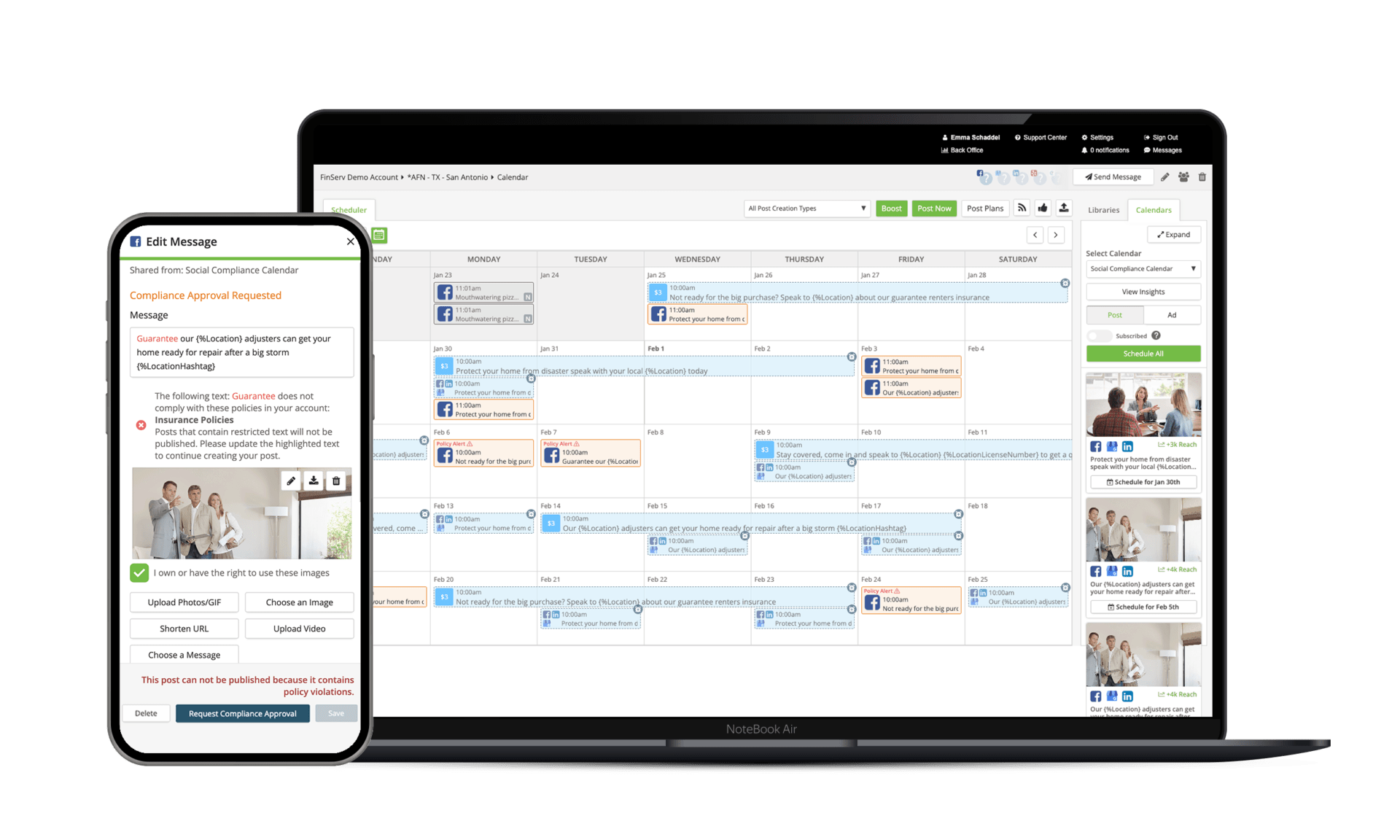

SOCi’s social compliance solutions also help local users and marketers mitigate the risks associated with non-compliance and brand inconsistencies. With SOCi’s social media management solution, you can oversee every social post across all locations published via SOCi or the native network.

SOCi also has automated keyword-based policies to assess and monitor compliance risks. You’ll be notified immediately via an email or push notification if local social content breaks one of your brand or compliance guidelines. Along with keyword policies, SOCi offers easy-to-use approval workflows. These workflows provide additional measures to improve compliance and save time.

For additional insight into how SOCi’s solutions can help your financial services company maintain compliance while exceeding your localized marketing goals, request a demo today!